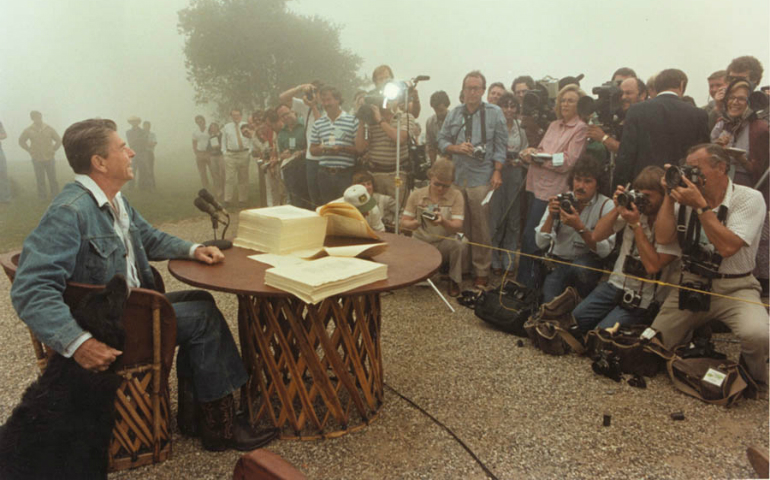

President Ronald Reagan signs the Economic Recovery Tax Act of 1981 at Rancho del Cielo, Santa Barbara, California, August 14, 1981. (White House photo, courtesy of Reagan Presidential Library)

Yesterday, I discussed the disconnect between President Donald Trump's pledges to help workers and the reality of his policies both as a private businessman and, now, as president. And I mentioned that as the administration turns its attention to tax reform, some of the same divisions within the GOP that killed the effort to repeal and replace the Affordable Care Act would manifest themselves on the rest of his agenda, too.

Coincidentally, The New York Times featured an op-ed about tax reform by four people who advised Trump during the campaign on economic matters: Steve Forbes, Larry Kudlow, Arthur B. Laffer and Stephen Moore, co-founders of the "Committee to Unleash Economic Prosperity," and each of them committed to the kind of laissez-faire economics that has hollowed out the American middle class over the past 40 or so years.

Regular viewers of EWTN's "The World Over" with Raymond Arroyo will recognize Kudlow, who is a regular guest on the show. Laffer is famous for the curve that bears his name, which was the justification for what become known as "trickle-down economics." Stephen Moore is with the right-wing Heritage Foundation and a former chair of the Club for Growth. Forbes is a libertarian zillionaire.

The four argue that Trump needs to keep it simple in reforming the tax code, and that his proposals should focus on three features: lower the corporate tax rate from its current 35 percent to 15 percent; allow businesses to deduct the full cost of capital investment rather than spread it out over years; and "impose a low tax on the repatriation of foreign profits back to the United States." That's it. Three key proposals, all of which have to do with corporations and all of which embody the kind of economic analysis that has left the people who became Trump voters by the side of the road for decades.

The authors insist, however, that "business tax relief is not a sellout to corporations but a boon for middle-class workers." They cite "a study by the Tax Foundation and Kevin A. Hassett, then at the American Enterprise Institute and now the chairman of President Trump's Council of Economic Advisers, [which] found that middle-class wages rise when business taxes fall."

Really? If the goal is to provide "a boon for middle-class workers," why not make them the object of immediate tax relief? Why not cut their taxes and simplify the tax code for them? The authors say they are "all for" an effort aimed at "fixing the maddeningly complex individual income tax system," but that this could wait for next year. They want economic growth and higher wages, and their way to achieve that is to line the pockets of corporate America.

We have heard this song before, and it is not plausible. It was never plausible, or to borrow a phrase from then-candidate George H.W. Bush in 1980, it is "voodoo economics." Pope Francis has told us what he thinks of this idea that the best way to help workers is to help the super-rich and hope the help trickles down. "Some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world," wrote Francis in Evangelii Gaudium. "This opinion, which has never been confirmed by the facts, expresses a crude and naive trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system."

The op-ed authors cite the economic growth that followed Ronald Reagan's tax cuts in 1981, but that is precisely when the stagnation of middle-class wages relative to the wealth of the top 1 percent began. It was the 1980s that saw greed become a good, celebrated on Wall Street and on popular TV, too. Remember the shows "Dallas" and "Falcon Crest?" Yes, the economy rebounded from its long slump on Reagan's watch, although I would give a lot of the credit to Paul Volcker, the Fed chair who rung inflation out of the economy with high interest rates.

Conversely, these economists who celebrate Reagan's legacy neglect to mention job growth in the 1950s when marginal tax rates reached up to 70 percent. Those years also witnessed higher wages for most Americans. Marginal tax rates affect business decisions, and profitability, at the margins as the name implies. No one abandons a sound business plan because of the taxes they will pay.

The other pernicious assumption made by the libertarian economic chorus is that progressive taxation is incompatible with simplification of the tax code. Rubbish. What is complicated about the tax code is the glut of exemptions, deferments, special treatment of different types of income and different types of personal or corporate expenditure. There is nothing complicated about the part that makes the tax code progressive: Once you have figured out your taxable income, you go to the tax tables and figure out what you owe. It is vital that Democrats expose this fallacy at the heart of GOP proposals that link simplification with regressive taxation.

The authors do make one smart political suggestion. They call on Trump to link his tax cuts for the top 1 percent with an infrastructure proposal. They place some conditions on infrastructure spending, all with a view towards diminishing the role of government and expanding the role of private enterprise. I am not afraid of the words "public spending," still less of "public roads." Toll roads, built and maintained by private firms, are a bad idea.

Of course, the Constitution vests the taxing power in Congress, and whatever Trump proposes, it will be Speaker of the House Paul Ryan and Senate Majority Leader Mitch McConnell who will have to craft the legislation and get it passed. As I mentioned, yesterday, the last time Speaker Ryan put a tax plan on the table, an analysis by the nonpartisan Tax Policy Center showed that 99.6 percent of the benefits would flow to the top 1 percent.

If Trump goes down the road suggested by the four horsemen of the libertarian economic apocalypse, Democrats need to be ready to pounce. The white working-class voters who put Trump into the White House surely did not do so in order to give tax breaks to the uber-rich. They know that trickle-down economics is not the answer. They are tired of being cast in the role of the poor man Lazarus, and trickle-down was made for the benefit of Dives.

The leaders of the Catholic Church in this country also must decide if they will stand with Pope Francis and echo his denunciation of trickle-down economics as this tax debate heats up. If not, why not? I understand that bishops often have to rub elbows with the wealthy, appealing to the generosity to support the work of the church. But the Holy Father has called us to become a poor church for the poor. There was nothing in the New York Times' op-ed about the poor, but there is plenty in the Gospels about the poor. We know where we should stand as Catholics, but will we?

[Michael Sean Winters is NCR Washington columnist and a visiting fellow at the Catholic University of America's Institute for Policy Research and Catholic Studies.]