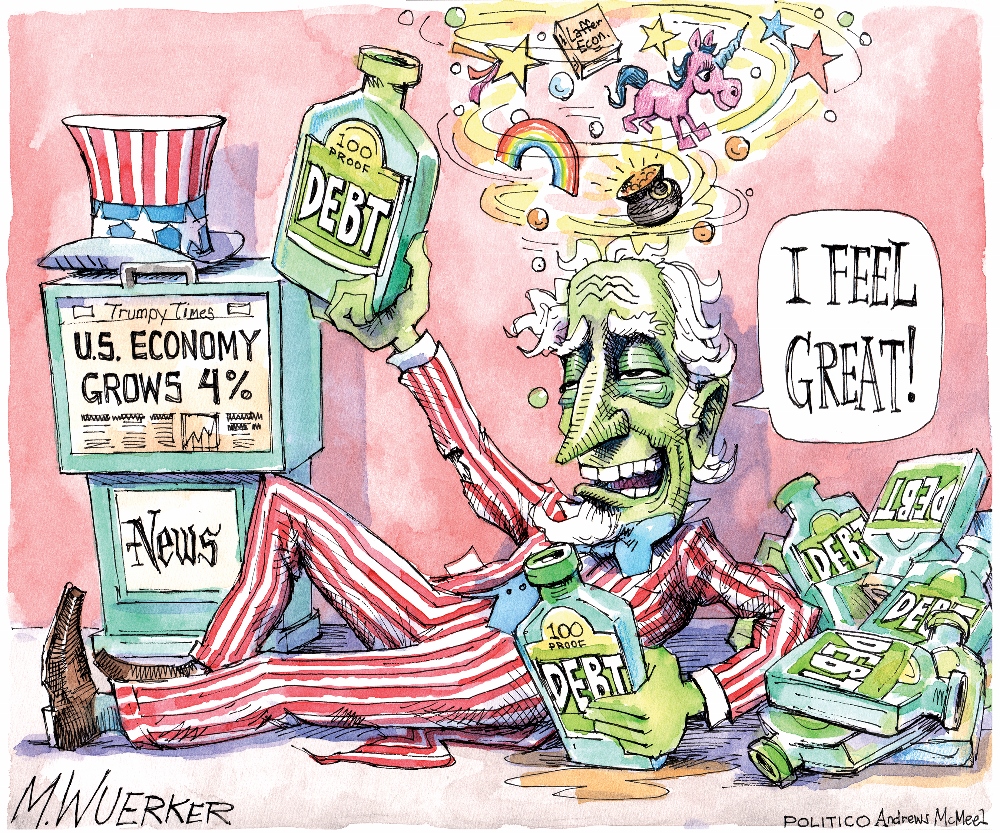

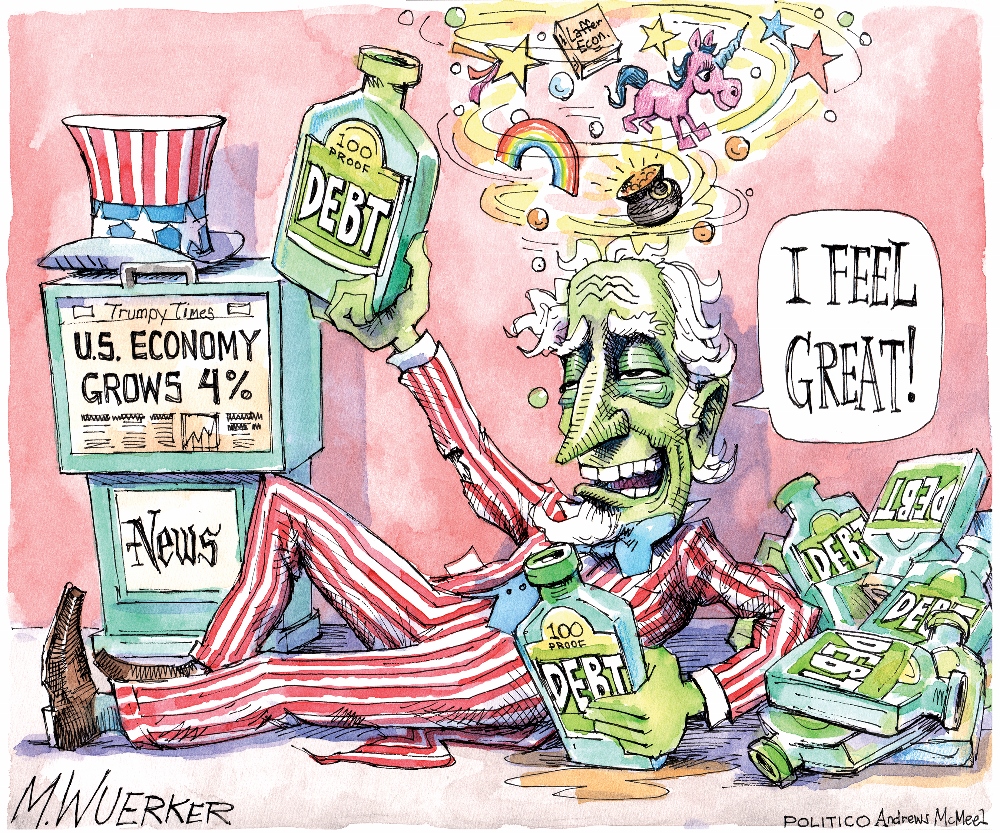

"We've accomplished an economic turnaround of historic proportions," President Donald Trump boasted from the White House steps in late July, announcing that the economy grew at a 4.1 percent pace in the second quarter of the year, nearly double the first quarter rate and the strongest pace in nearly four years.

Similar hyperbole followed the August jobs report: an unemployment rate of below 4 percent since April, numbers that haven't been seen in a generation.

"Once again, we are the economic envy of the entire world," the president said. Certainly, members of his party running for re-election this November would like to focus on these kinds of numbers (and take credit for them). Those who do run on the economy, especially those who call themselves fiscal conservatives, should be questioned by the electorate, because these "historic numbers" mask the fuller story of the U.S. economy, which is far from rosy.

The 4.1 percent gross domestic product growth in the second quarter could well be a blip — we won't know for another couple of quarters — and spurred as it was by a surge in consumer spending, most economists agree that this is a one-off growth spurt, unlikely to be sustainable. The growth would well be a bubble created by the tax cuts Congress passed in December.

The unemployment number also masks deep flaws in the economy, two sinister and longer-term trends.

First, part of the reason the unemployment rate is lower is because fewer people are searching for jobs. The labor participation rate — the percentage of the entire population, working age or not — either employed or actively looking for work is holding steady at about 63 percent. A strong economy should be producing more jobs, but ours isn't, not over the long term.

Job growth is happening in call centers and distribution/warehouse operations — another sign of our economy's future — while jobs are being shed in the manufacturing sector, supposedly the centerpiece of Trump's economic and trade policies. The auto industry, which is particularly vulnerable to trade, eliminated 4,900 jobs in August after cutting 3,500 in July, according to The New York Times. (Some economists also say that Trump's erratic talk and inconsistent management of trade relationships is actually working against GDP growth.)

The second trend is wages. Despite nine years of economic recovery and growth, wages have stagnated, barely keeping ahead of inflation. This trend, well-documented over many years and studies, tracks with another years-old, well-documented trend: the growing gap between rich and poor.

Advertisement

Looking at these rosy economic numbers, then after lifting our colored glasses, we find a fragile economy made even more fragile by the key (the sole) achievement of the Republican-controlled Congress, the December 2017 tax plan. That plan, rushed through the legislative process with virtually no scrutiny, gave lip service to the middle class, but its tax cuts benefited the richest households and profitable corporations. And as predicted, it has set federal deficits soaring. Even the record growth we see now can't offset the deficits.

It's the "perfect storm," Stan Collender, a financial journalist, told National Public Radio. "You've got more spending. You've got less revenue. And the deficit is just getting bigger and bigger, to the point where it will be at least a trillion dollars every year during the Trump administration and beyond."

Instead of fixing the problems in the December 2017 plan, however, House Republicans are doubling down. They have proposed a "2.0" tax plan that would make the 2017 law's individual tax provisions, which are to sunset in 2025, permanent.

As we have noted before, these tax cuts are just the first part of the Republican leadership's plan to cut programs that support low- and middle-income Americans. Eventually these leaders will decry the ballooning deficits, and they will call for deep cuts in Medicaid, Medicare and basic assistance programs like the Supplemental Nutrition Assistance Program, or SNAP (formerly known as food stamps). Republicans have spent years whittling away at these programs, but now budget plans call for cutting funds from education and training programs, transportation and other infrastructure, medical research, child and elder care, and other priorities that benefit nearly all Americans.

Congress must withdraw the tax plan 2.0 before more damage is done to our economy. The next Congress can then begin the work of real tax reform that benefits the majority of citizens, not the wealthy elite and corporations.